By Aaron Burcell, Managing Director, Growth & Digital Marketing, Roc360.com

No matter where you are in your real estate investing journey, one simple fact will always remain true: finding the right loan to launch each project is essential to realizing your ultimate portfolio performance and value goals.

However, the lending market doesn’t do you any favors. Complexity is a massive barrier to making the best loan decision: comparing lenders, loan products, rates, terms, eligibility and down payment requirements is a grueling exercise that can consume precious time and energy.

If you want to get the most return on your real estate investments, there’s no way around it: becoming informed about the variety and performance characteristics of available real estate loans is a mission-critical task. Following is an overview of common loan types that is helpful to have handy whether this is your first rodeo, or you’re a seasoned real estate investor.

How to Build a Real Estate Portfolio

First, let’s be clear about what we’re talking about. If you only buy a home to live in, it’s likely to grow in value: that feels good, but it’s not a viable pathway to financial freedom. It’s not real estate investing and you’re not building a real estate portfolio.

A real estate portfolio is something larger and more purpose-driven. It’s a collection of property assets that can include:

- Individual investment properties or rehab projects

- Rental properties

- Real estate investment trusts

No two real estate portfolios look alike, however they all share a function: to help investors move closer toward achieving investment goals or total financial freedom. Portfolio growth is the best way to make those goals happen.

So how do you build the value of your real estate portfolio? With your goals in mind, whether it’s total financial freedom or something more limited like creating a monthly income or funding your kids’ college education, you create an investment plan that allows you to buy more properties and grow your portfolio.

And that’s where understanding how to choose the right real estate loan comes into play. To buy more properties and grow your portfolio, you’re going to need access to financing. By being informed and making the best decisions about how to finance your real estate purchases, you support optimal real estate portfolio performance and growth.

Which Types of Loans Are Available

There are numerous options available for investment property financing, each with different criteria and advantages. Choosing the right type of loan is essential to investment success, so it’s critical to understand the requirements and performance characteristics of each.

Conventional Bank Loans

A conventional bank loan is the most common solution for real estate financing. Guidelines are set by Freddie Mac or Fannie Mae and include a down payment of 20-30% of the purchase price. Your credit score and credit history are used to determine your eligibility and the applicable interest rate, and you’ll need to demonstrate the ability to afford any previously existing mortgages and the new one.

There’s a limit on the number of Freddie Mac or Fannie Mae loans you can have at one time, usually somewhere between six and ten. This means that there’s an eventual cap to using these loans to grow your real estate portfolio. They are also not broadly suited to the wide variety of project types in a diversified investment portfolio. However, if you have ample cash on hand, good credit and prioritize stability over asset growth for your real estate portfolio, a conventional bank loan is a solid choice.

Fix & Flip Loans

If your project involves a distressed property and its quick renovation, improvement and sale, a fix & flip loan is ideal for your purpose. The advantages of these loans are:

- Fast approval times match the need for quick cash to get a project moving; traditional home loans can take a month or longer to process and deliver, while a fix & flip loan can usually begin delivering cash within a week.

- Short term duration is ideal for a project that’s intended for a quick resolution; instead of the 15-30 year term for a traditional home loan, a fix & flip loan typically has a term of under two years.

- Less risk is involved because a fix & flip loan is guaranteed by the property itself, not your personal credit or property; if the project doesn’t work out, your losses are limited.

Simplicity is often an additional benefit for fix & flip loans: loan origination and construction draws are often managed by a single lender, which makes management easier and more convenient, with a single point-of-contact throughout the loan process. That allows you to focus on your project, rather than manage complicated financing details.

A short term means you’re going to be paying more in interest for a fix & flip loan, which makes this a poor match for a long-term project. However, there’s also some flexibility available if the market changes or the project drags on and a different financing solution is required. You can convert to a conventional bank or home equity loan if keeping the property is the better plan or add a bridge loan to get you past a difficult funding challenge.

Whether your project just needs minor renovations, or is a complete reconstruction, a fix & flip loan is the ideal short term lending solution to help your project deliver maximum returns.

Home Equity Loans

If you have equity built up in a property, you can use a home equity loan (sometimes called a “second mortgage”) to access that money for new real estate investments. Home equity loans are simple to understand and very predictable: you apply for the amount you want to borrow, and when approved receive the full amount in a lump sum. The interest rate is fixed, as is the schedule of repayments for the loan term

A home equity loan is an attractive source of financing for investments to grow your real estate portfolio because, 1) the interest rate is lower compared to many other types of financing, 2) it provides a large cash infusion without diverting from other investments, and 3) it provides an easy way to tap into value that is otherwise difficult to utilize. Depending on the size of the loan, interest payments may also be tax deductible.

Ground Up/New Construction Loans

Ground up or new construction financing exists as a distinct real estate loan type and is purpose-built to meet specific needs. Whether you’re building to sell or building to rent, it’s a streamlined financing solution that helps real estate investors lock in bigger profits for projects that are ready to begin construction:

- Shovel-ready lots

- Tear-down projects

- Spec houses or model homes

- Infill developments

A ground up loan is an ideal fit if you’re an active real estate investor and you want to get started on your next project without waiting through a long-term lending process. It’s also perfect if the project is shovel-ready and everything is in place except for the financing. A new construction loan is also suitable as an alternative to a fix & flip loan for projects that require more substantial work, e.g. vertical additions or significant horizontal additions that fall outside the usual scope of a fix.

The underwriting process is much less involved than with a traditional home loan, since only the risk of the project itself is relevant. That makes approvals fast – usually under two weeks – for a short term that’s typically 6-36 months. A 70-75% loan to ARV ratio is usual for this class of loan.

If the market changes and a sale following construction is not the best path forward, you can refinance into a permanent mortgage, so you have a financing solution that better matches your investment goals.

Ground up/new construction loan programs help your real estate portfolio grow with a solution that closes quickly, while enjoying the support of a reliable and experienced financing partner.

Bridge Loans

Sometimes the right permanent financing is temporarily out of reach, or you need quick cash to meet an unresolved debt obligation. Typically, this is caused by some challenge that requires time to remediate:

- New construction/upgrades are needed to boost your investment property’s value

- Current occupancy is low and needs improvement

- Rental rates are unfavorable and await an upward swing

- Permanent loan approval process is extending past your comfort level

- Transition time between selling one property and buying another leaves you short

For whatever reason, circumstances are not ideal, and you need time to stabilize within a short transitional period before better permanent lending options will become available. This is the ideal time to consider a bridge loan, which can provide immediate cash flow to help you get your ducks in a row.

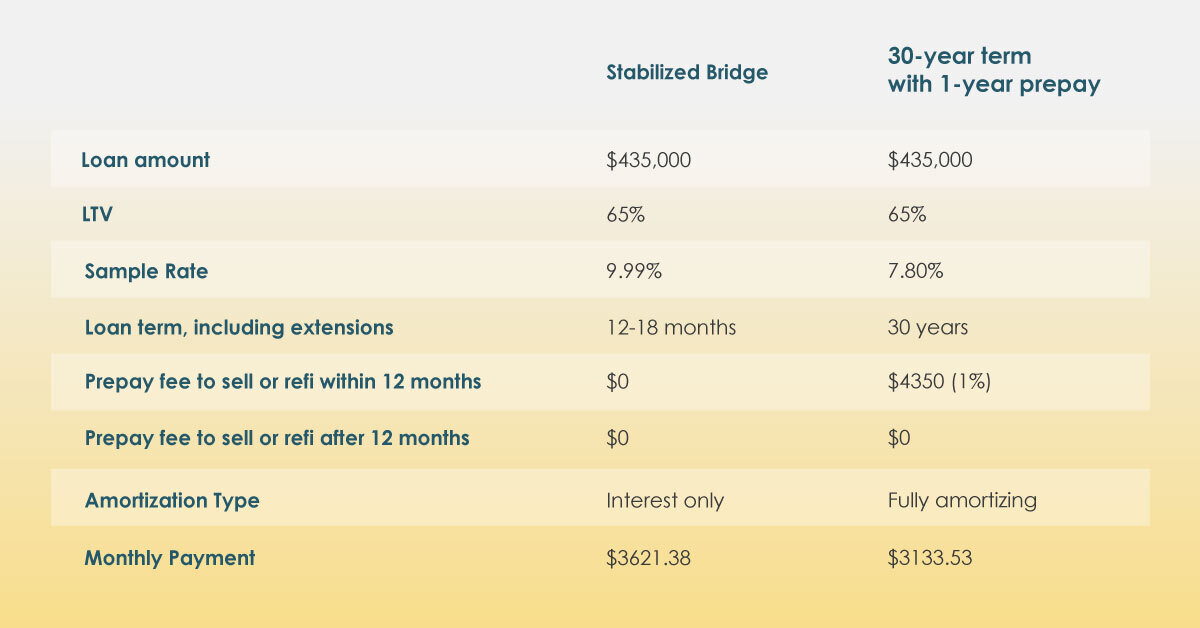

When all you need is a little extra time to transition into a more stable and rewarding investment position, a bridge loan can provide you the breathing room needed to stabilize and, eventually, move forward. Bridge loan terms are short – usually 6-24 months, with options to extend – and structured flexibly to make them suitable for a variety of real estate project types.

You’ll pay a higher interest rate than you would for a longer term loan, and bridge loans are definitely not intended to replace traditional financing. Your credit score and debt-to-income ratio will be important factors in the approval process, and the loan-to-value ratio is typically less – often around 80% – than with other real estate loan products.

If you have temporary cash flow challenges within your real estate investment portfolio, a bridge loan can provide the resources to get you from where you are to where you want to be and help maintain forward momentum for your investing journey.

Which Loan Is Right for Your Portfolio?

If you have a suitably diverse portfolio, any of these loan types could be right for you at one time or another:

- A conventional bank loan is perfect for projects where you have ample time, no credit worries, and want the assurance of an experienced, trusted lender at your side.

- If you have a home that needs a little love to unlock its earning potential, choose a fix & flip loan that’s fast and hassle-free.

- If you need a large lump sum and also have lots of equity, good credit, and time on your side, then a home equity loan is a great way to get the cash needed to nourish your portfolio.

- When you have everything in place for a shovel-ready construction project except the financing, a ground up/new construction loan is your ideal financing solution.

- And if you need some cash immediately to buy time to get you from point A to point B in your investing journey, choose a bridge loan that delivers quick cash and resolves quickly.

The key is to understand your project, process and goals, and then tailor the loan choice to support them in the most effective way.

Seek Out Loans Precisely Tailored to Your Needs

Bottom line: there’s a lot you can be doing with your money, it just requires buy-in from you to discover the right loan product match that supports your investing goals. Look for competitively priced loans that are tailored to your needs, and an investor-friendly process that is designed to help you get the most from your money.

Financing is a key element in your real estate investment strategy. Don’t let a bad loan decision compromise your real estate portfolio performance. There are solutions out there that provide optimal returns – it’s up to you to be active and find them.