Interest rates have gotten higher, but that doesn’t mean they’re high.

The pandemic has made us re-examine how we do just about everything in our lives. I have been going to the same barber, Shukuru, for many years and I’m always joking that I never understood why I’m charged more as the years go by, because I have less hair to cut. Now, my wife does my hair. It’s a more efficient and a cheaper way to cut my dwindling amount of hair. This is a personal story, but it’s just one example of consumer behavior change during the pandemic. And, it’s an example of how certain businesses have suffered. Of course with these changes comes opportunity. Change is certainly playing out in the real estate markets as well. You can argue that, once the pandemic is over, things will go back to normal, but some of our behavior will be permanently changed. In my last post, I wrote about some of the changes we expect to see in the real estate markets. At Roc360, we continue to monitor and share how real estate trends have changed as we return to normalcy, whatever that may mean.

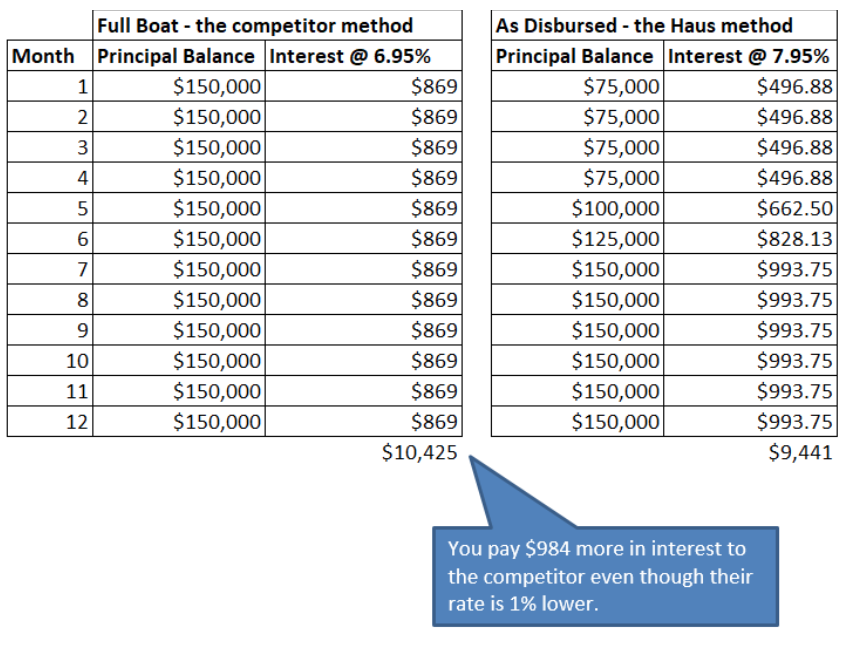

Today I want to share some more detailed insights on the power of interest rates. I will also share some of the creative ways our borrowers have overcome challenges in order to get their deals done.

A. Interest rates

-We have been in a low interest rate environment for so long that we sometimes take these low rates for granted, assuming that they will always be available to make our real estate deals work. Mortgage rates have been rising over the past few weeks. Last week the average rate for a 30 year fixed mortgage climbed above 3% for the first time since July when the rate was at a record low of 2.65%.

Even small interest changes can have an impact on the affordability of housing.

Let’s illustrate with some specific examples.

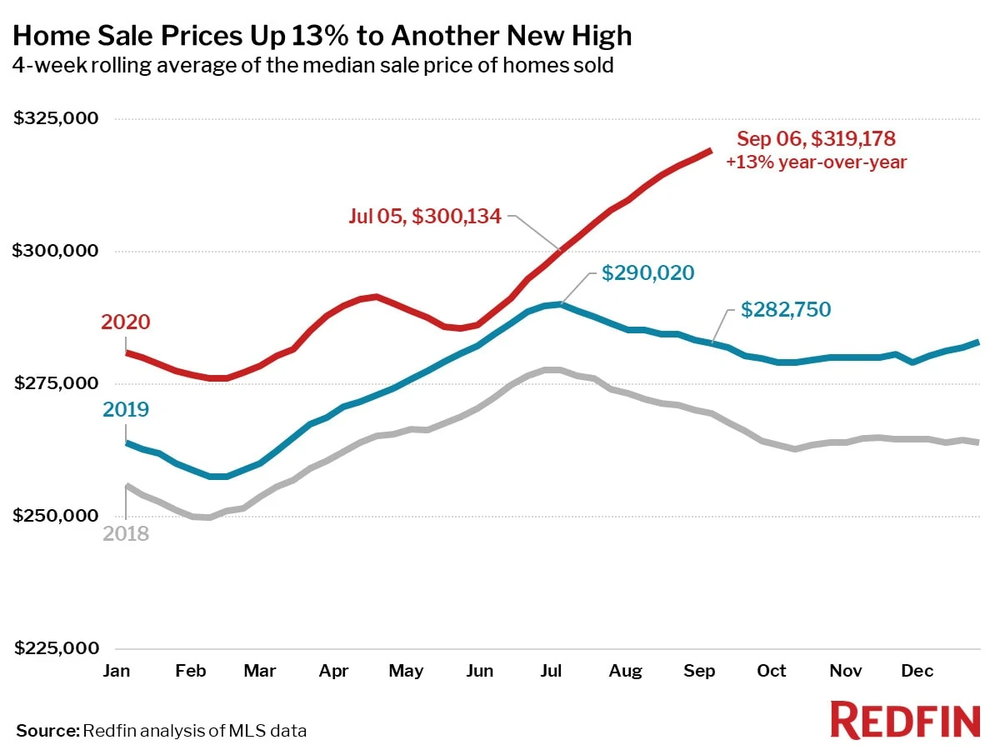

The median home purchase price climbed above $300,000 for the first time last year so if we use

that figure as the loan amount at the record low rate of 2.65% in July that would require a monthly payment of $1208. A 3.25% 30 year fixed rate mortgage which is closer to where we are currently would necessitate a monthly payment of $1305. To put it in perspective the historic peak mortgage rate was at 18.63% in 1981 when a monthly payment of $4675 was necessary. Even in December of 2018 when rates were at 4.64% the monthly payment was $1545 . The point is that rates matter and even the recent increase in rates has resulted in about $100 a month increase in costs. If you add in the higher prices of homes which increased by 10.8% in the fourth quarter which was the biggest annual increase since 1992 you can see why some might question the continued rally in home prices. Additionally many economists expect mortgage rates to continue to increase this year.

Rising rates would not only affect the ability to do new deals, but also adversely impact

“borrowers” (including the federal and local government)

ability to pay their existing floating rate debt and roll over their existing debt. If rates do continue to rise, we’ll be dealing simultaneously with higher debt-service costs across the economy on existing projects along with a curb on new economic activity because of the higher cost of debt for new ventures.

So, where are rates going from here?

Many of us think that we will be in this low interest rate environment for a long time.

Federal Reserve Chairman Jerome Powell was quoted as saying “We think that the economy’s going to need low interest rates, which support economic activity for an extended period of time—it will be measured in years. However long it takes, we’re going to be there—we’re not going to prematurely withdraw the support that we think the economy needs.”

So, if you believe the Fed chairman, rates will stay low, although, bear in mind that the Fed controls short term rates to an extent but certainly does not have control over longer term rates and broader market forces. If you believe the writer Norman Cousins who said “History is a vast early warning system”, low interest rates are not going to last forever. It might be foolish on my part to bet on a writer rather than the chairman of the Federal Reserve, but that’s exactly what I am going to do. Call me old fashioned, but I don’t believe that governments can print money with no consequences—that you will be able to get a 30 year mortgage at 3.25% forever and this time it’s different…not likely. Housing affordability is a function of financing costs, income and home prices. One can argue that each of these factors could cause stress on the system going forward. But for now, even with this recent increase in rates, many of the factors that have created demand for single family housing remain in place. Owning your own home is still theAmerican dream and housing stock is still in short supply. Just understand that rates weren’t always this low and might not stay like this forever.

B. Borrower story-

We applaud our borrowers’ entrepreneurial spirit and vision in pursuing their projects and dreams. Each and every day we observe our borrowers doing deals that transform communities and people’s lives. One of our borrowers bought three multi-family buildings with 70 units in North Carolina. He grew up nearby in the same town but wasn’t even allowed by his Mom to go near the location of the properties because they were so rundown. He did some incredible work rehabbing the buildings and the units are now rented and the property is stabilized. An article ran in the local newspaper about how he improved the community with his rehab of these properties. This is just one illustration of how our incredible borrowers create their vision and get things done. The pandemic has put up additional roadblocks, but our borrowers always seem to find a way. People’s lives are enhanced time and again because of this initiative. More stories to follow.

C. Trivia-

Let’s review the answers to the trivia from the previous blog first.

What is the largest private real estate development project in American history?

Answer: Hudson Yards in New York City, with a cost of $25bn on 28 acres.

What was the nickname of the Empire State Building when it was opened in 1931?

Answer: The Empty Space building, because it was hard to lease after The Great Depression.

In what country do homeowners paint their front door red when they pay off their mortgage?

Answer: Scotland, although I believe it might be a bit of a myth.

New new trivia question: Who is the world’s largest landowner?

Post your answers on our Facebook page and we may have a prize for you.

About the author

Brandon Dunn is the Chief Capital Markets Officer at Roc360. Brandon began in fixed income sales and trading roles at institutions such as JP Morgan, Deutsche Bank, Smith Barney and LF Rothschild. He later became co-head of trading groups and Managing Director and Head of Structured Product Marketing at UBS. At Roc360, Brandon is responsible for all capital markets related activity and investor relations. He supports these efforts by leading the origination team and being involved with due diligence processes.

See our recent posts

What to Look for When Sourcing a Loan for Your Rental Portfolio

Choosing the right financing tools is critical to maximizing returns...

Top 7 Real Estate Investment Terms You Should Know

Top 7 real estate terms you should know to build...