Financing rates are higher and more volatile than any time...

Melissa Deal, Head of Sales, explains how new loan products from Haus Lending are helping borrowers adapt to higher interest rates and a slowdown in housing market activity.

Financing rates are higher and more volatile than any time in recent memory, and the outlook on the housing market is more uncertain than it has been in a decade. This state of affairs seems likely to continue for the next 6 to 12 months, if not longer.

Borrowers are understandably worried about adjusting to this mix of conditions. The current environment has caused many active real estate investors to pause and take stock, leading to a natural slowdown in new transaction activity on investment properties. More importantly, borrowers looking to sell or refinance their renovated properties are increasingly concerned about the exit potential of their current loans against the twin headwinds of rising rates and a slower pace of home purchases.

In the context of turbulence in the housing market, Haus Lending has introduced borrower-friendly features in existing loan products as well as launched new loan products to help borrowers navigate this environment.

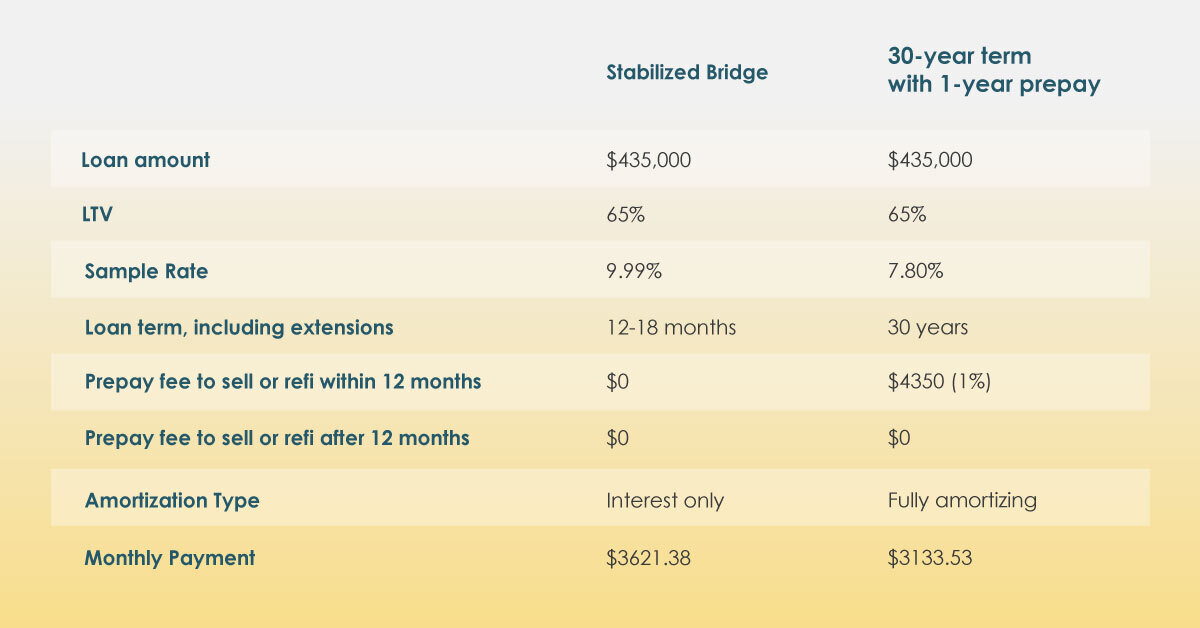

At the core of Haus Lending’s efforts to meet the needs of borrowers and investors in this market are two recently launched products:

Consider a typical use case of a borrower who purchased a home 12 months ago, took on a bridge loan, finished renovations, and is now looking to sell in this market. Their challenge is that rates are much higher and borrower demand is potentially lower than anticipated as affordability becomes more challenging for would-be homebuyers.

What are their choices? They can choose to take a chance to sell their finished property into this weaker market, not knowing if or when it could sell and at what price. Alternatively, they can try to rent the property profitably. And here’s where Roc Capital’s new products come in.

We’re here to fund your loans and enable your success. Our product offerings have been designed specifically to ensure our borrowers’ success. We provide you with unmatched resources in the market. Our team has your back and we will work tirelessly for you.

Want to learn more about Stabilized Bridge, 1-year PPP 30-year Term or our other products that can help you ride out these rough times? Call us at 1-877-GO-4-HAUS or apply for a loan today!

Choosing the right financing tools is critical to maximizing returns...

Top 7 real estate terms you should know to build...