Financing rates are higher and more volatile than any time...

A 6.95% rate is always going to beat a 7.95% rate, that’s grade school math, right? That’s what some lenders want you to think when they advertise a low rate, but that’s not always the case.

The problem is in the fine print, specifically relating to how the interest rate is applied to the loan principal. Here’s what you need to know to understand whether the low rate you’re offered is really the lower payment amount you’re expecting.

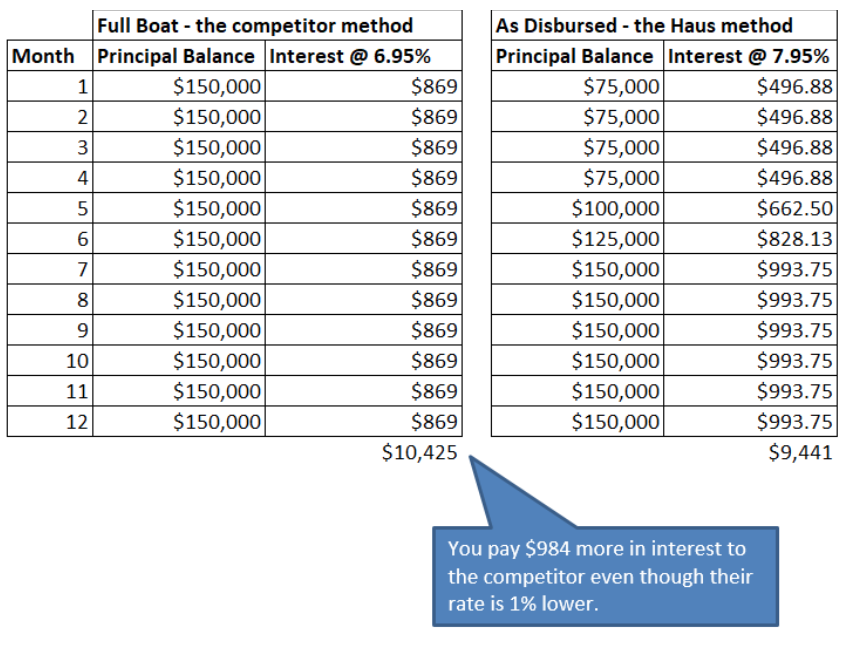

Here’s a simple example. Your company is looking for a $150,000 loan with a one year term. $75,000 is to be used toward the initial purchase of the property and there will then be three subsequent $25,000 construction draws at months 5, 6, and 7.

With a full boat loan at the “low” rate of 6.95%, you’ll pay interest against the $150k from day one for the full 12 months. However, with an “as disbursed” loan at the higher rate of 7.95%, you pay interest only against the money you’ve actually received. Here’s a closer look at the math:

In the example chart, a “lower” rate full boat loan actually results in you paying close to $1,000 more in interest vs. an as disbursed loan. Haus Lending charges interest as disbursed.

Unfortunately, charging full boat interest is a common practice that lenders use: they advertise loans at low rates that appear to be better deals, but because you pay interest on the total amount right away, you end up paying more in the long run.

Choosing the right financing tools is critical to maximizing returns...

Top 7 real estate terms you should know to build...